-

-

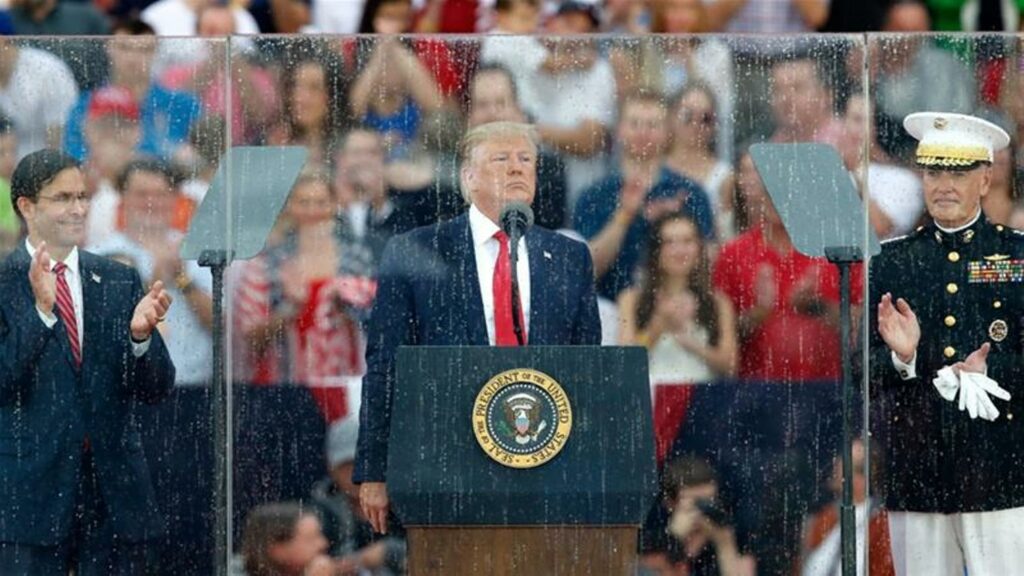

Critics of the president have accused Trump of politicising celebrations. PHOTO: AP Donald Trump paid no federal income taxes whatsoever in 10 out of 15 years beginning in 2000 because he reported losing significantly more than he made, according to an explosive report released Sunday by the New York Times.

The President paid just $750 in federal income taxes in both the year he won the presidency and his first year in the White House, according to more than two decades of his tax information obtained by The Times. -

At a White House briefing Sunday, Trump denied the New York Times story and said he pays “a lot” in federal income taxes. “I pay a lot, and I pay a lot in state income taxes,” he said.

-

Trump added that he is willing to release his tax returns once he is no longer under audit by the Internal Revenue Service, which he said “treats me badly.” The President is under no obligation to hold his tax returns while under audit, but has been saying that for years. The President repeatedly refused to answer how much he has paid in federal taxes in the briefing and walked out to shouted questions from CNN’s Jeremy Diamond on the topic.

-

The expansive Times report paints a picture of businessman who was struggling to keep his businesses afloat and was reporting millions in losses even as he was campaigning for President and boasting about his financial success.

-

According to the newspaper, Trump used the $427.4 million he was paid for “The Apprentice” to fund his other businesses, mostly his golf courses, and was putting more cash into his businesses than he was taking out.The tax information obtained by the Times also reveals Trump has been fighting the IRS for years over whether losses he claimed should have resulted in a nearly $73 million refund.In response to a letter summarizing the newspaper’s findings, Trump Organization lawyer Alan Garten told the Times that “most, if not all, of the facts appear to be inaccurate” and requested the documents.The New York Times said it will not make Trump’s tax-return data public so as not to jeopardize its sources “who have taken enormous personal risks to help inform the public.”The tax-return data obtained by the newspaper does not include his personal returns for 2018 or 2019.Trump’s taxes have been largely a mystery since he first ran for office.During the 2016 campaign, the then-candidate broke with presidential election norms and refused to produce his tax returns for public review. They have remained private since he took office.Being under audit by the IRS does not preclude someone from releasing their tax returns publicly. But that hasn’t stopped Trump from using it as a defense against releasing his financial information.In 2016, Trump released a letter from his tax attorneys that confirmed he was under audit. But the letter also said the IRS finished reviewing Trump’s taxes from 2002 through 2008. Trump did not release his tax returns from those years, even though the audits were over.Additionally, the Times reported Sunday that Trump’s tax information reveals specific examples of the potential conflicts of interests between the President’s business with his position.The President has collected an additional $5 million a year at Mar-a-Lago since 2015 from new members. A roofing material manufacturer GAF spent at least $1.5 million in 2018 at Trump’s Doral golf course near Miami while its industry was lobbying the government to roll back federal regulations, according to the Times.It also found that Billy Graham Evangelistic Association paid more than $397,000 to Trump’s Washington, DC, hotel in 2017.The Times reported that in Trump’s first two years in office, he has collected $73 million in revenue overseas, with much of that coming from his golf courses but some coming from licensing deals in countries, including the Philippines, India and Turkey.The Times said all of the information obtained was “provided by sources with legal access to it.”A previous New York Times investigation published in 2018 reported that Trump had helped “his parents dodge taxes” in the 1990s, including “instances of outright fraud” that allowed him to amass a fortune from themTrump received at least $413 million in today’s dollars from his father’s real estate empire, starting at the age of 3.This story has been updated with additional information from the New York Times’ report.

-

The post Trump paid no income taxes in 10 out of 15 years, New York Times reveals appeared first on Vanguard News.

https://ift.tt/339wYWk by Victor Ogunyinka via Vanguard News Albert Einstein Fools of Fortune

- Get link

- X

- Other Apps

Labels:

Article

Headlines

Hot Now

Important

International

Just Released

Local

National

News

Newsletter

Trending

- Get link

- X

- Other Apps

Comments

Post a Comment